Despite the recent influx of negative news in the media, Melbourne’s property market hasn’t taken such a dive.

The city’s growth was the lowest it has been in 5 years however we still managed to grow by 0.1% to $914,528 at which point, unit prices did a little better at a gain of 0.7% bringing it to $505,861.

Interesting right? Whilst the media is telling us we are at a turning point, we are still managing to push a market gain.

So what does this tell us?

In the eyes of a first home buyer, this is probably not good news. You are not going to get your lucky break and be able to afford a home in the location and the price you were hoping for simply because it is not 1991 anymore.

However, if you’re reading this from the perspective of a seller, you are definitely in luck.

let’s say you’ve had your home for 2 years, you were lucky enough to ride the gain train. Which would mean you’re better off now, financially, than you were 2 years ago.

This arguably may be the best time to sell.

Hear me out.

Your home of 2 years has yielded a profit of roughly 14% over 2 years from 2016 to 2018.

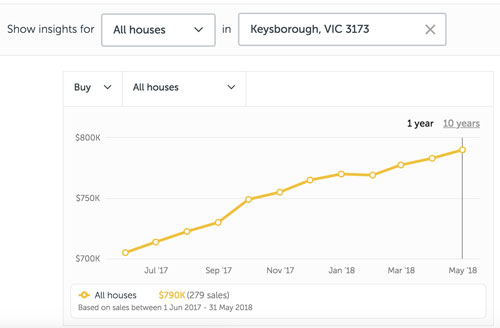

Keysborough 13.5% growth

Dandenong 10.8% growth

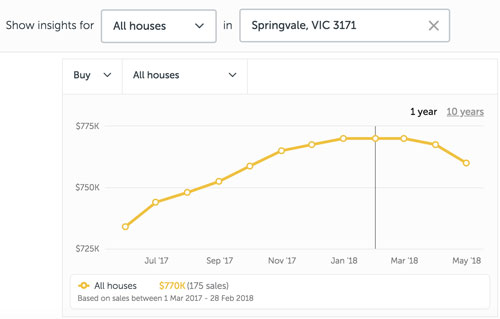

Springvale 11.6% growth

So while the market is slowing down in growth, you would be in an ideal situation to sell your home. Regardless if you are buying up or buying down, your next home will leave you with more money in your hands.

The new home you may purchase won’t plummet dramatically and your current home will sell at a profit from when you first purchased.

To us, it seems like this current real estate climate has put you in the perfect situation.

Find out what your home is worth for free, click the link below to get started.

We will help you compare your current house value with that of when you purchased and help you make an informed decision on your next step.